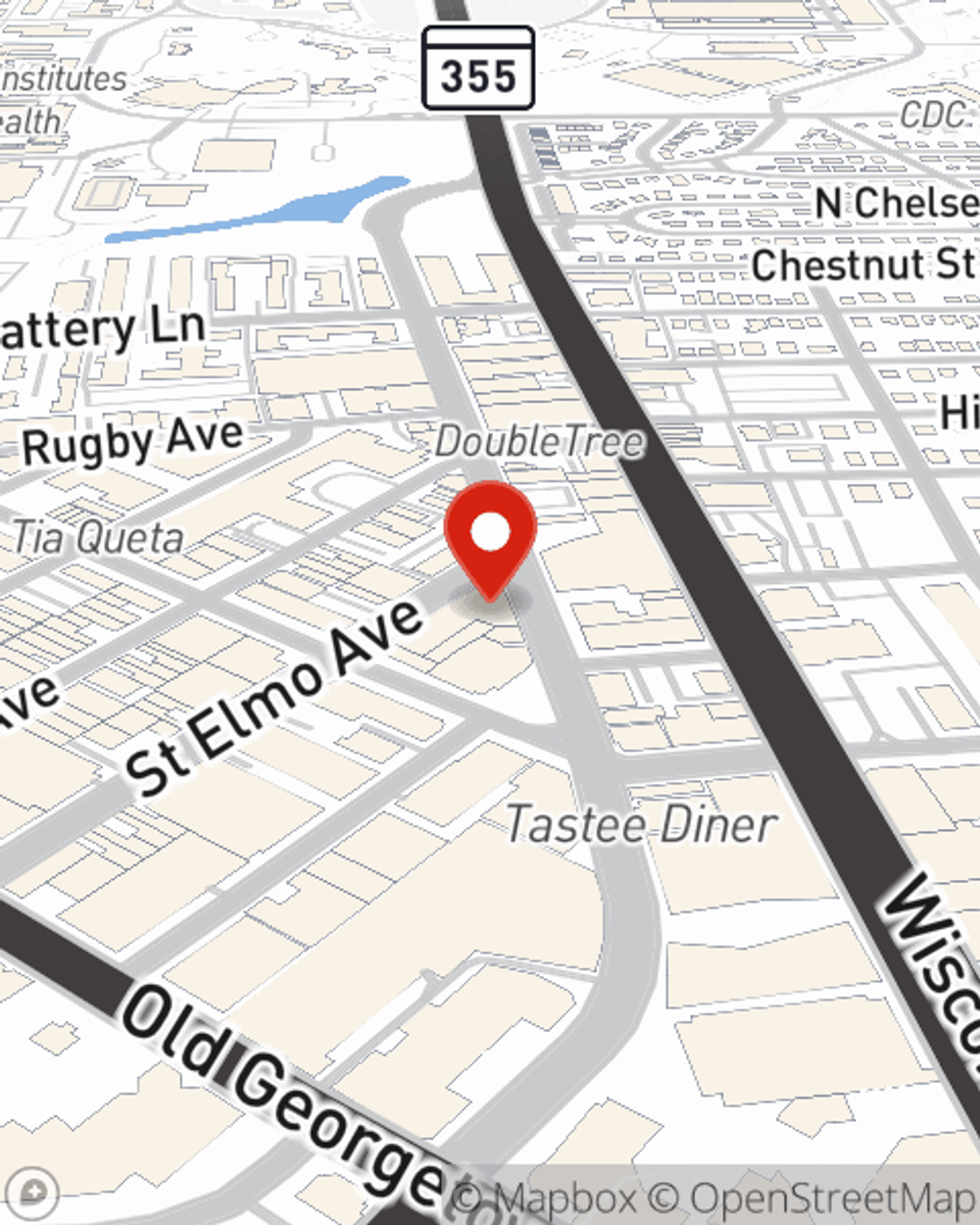

Business Insurance in and around Bethesda

One of the top small business insurance companies in Bethesda, and beyond.

No funny business here

- Bethesda

- Bethesda, MD

- Chevy Chase, MD

- North Bethesda, MD

- Chevy Chase

- Bowie, MD

- Bel Air, MD

- Montogomery County

- Kensington, MD

- Walkersville, MD

- Annapolis, MD

- South Kensington, MD

- Chesapeake Beach, MD

- Fairfax County

- Arlington County

Cost Effective Insurance For Your Business.

When experiencing the challenges of small business ownership, let State Farm be there for you and help provide excellent insurance for your business. Your policy can include options such as extra liability coverage, worker's compensation for your employees, and business continuity plans.

One of the top small business insurance companies in Bethesda, and beyond.

No funny business here

Protect Your Business With State Farm

Your company is special. It's where you make your living and also how you make a life—for yourself but also for your loved ones, and those who work for you. It’s more than just a shop or an office. Your business is a reflection of all your hopes and dreams. Doing what you can to keep it safe just makes sense! A next great step is to get outstanding small business insurance from State Farm. Small business insurance covers a plethora of occupations like a podiatrist. State Farm agent David Munson is ready to help review coverages that fit your business needs. Whether you are a pharmacist, a psychologist or a real estate agent, or your business is an antique store, a beauty salon or a pizza parlor. Whatever your do, your State Farm agent can help because our agents are business owners too! David Munson understands the unique needs you have and is ready to review coverages that meet your needs. With State Farm, you’ll be ready to grow your business into a bright future.

Ready to consider the business insurance options that may be right for you? Call or email agent David Munson's office to get started!

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

David Munson

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".